- Homepage

- Varun Hiremath

- Digital Financial Literacy: Varun Hiremath Empowering Youth Entrepreneurs

Digital Financial Literacy: Varun Hiremath Empowering Youth Entrepreneurs

Introduction:

Entrepreneurship starts with knowing money well. Many young entrepreneurs find it hard to handle business finances, get funding, or invest smartly. Varun Hiremath is working to change this by teaching digital financial skills to young people so they can succeed in today’s economy.

Varun Hiremath has blended technology and education and has made a combination aimed to educate the next generation entrepreneurs with the necessary knowledge on finance, education and technology. He is guiding them with the necessary knowledge to manage finance effectively and impactfully. He is a brilliant teacher and knows how important it is to educate the future generation with financial literacy. It is needed to become self- reliant in life. Varun Hiremath is helping young entrepreneurs handle finances, make smart choices, and grow lasting businesses.

His mission is to provide the next generation entrepreneurs the confidence and competence to navigate the complexities of business finance in an increasingly digital world.

The Importance of Digital Financial Literacy for Youth:

It is very important to educate the youth of India with financial literacy as the statistics say that most of the Indian people including youth are lacking financial literacy but not lacking wealth! As a result of it as entrepreneurship changes, young innovators face new money challenges, like:

- They have limited understanding of digital payment systems and modern day financial tools.

- They often struggle with funding and investments.

- They face difficulties while budgeting, cash flow management, and financial planning for their future.

- They can be easily tricked or make mistakes in handling their money.

Varun Hiremath is a brilliant man and knows the importance of digital financial literacy, and he believes that in today's fast evolving world digital financial literacy can genuinely empower the next generation entrepreneurs to overcome these obstacles. By teaching them to use digital tools well, young innovators can make smart financial choices, avoid scams, and keep their business money healthy.

Fintech Platforms as Learning Tools:

To connect theory with practice, Varun Hiremath uses fintech tools to help young people learn money management hands-on. Some tools he uses are:

- Digital wallets and payment apps help track transactions and manage money easily.

- He teaches them how to make a budget, and how to manage their expenses through apps. These teachings help the young entrepreneurs to control their expenses and they start to plan how to control their spending for the future.

- Investment simulators help them understand how markets work, the risks involved, and how to manage investments.

- Crowdfunding and digital loan platforms show young entrepreneurs how to get funding for their startups.

These tools give young entrepreneurs practical experience in managing money, helping them understand the technology that drives today’s financial world.

Workshops and Online Programs:

Varun Hiremath knows the importance of education, he believes that true changes can never happen without quality education. Education is at the heart of Varun Hiremath’s work in digital financial literacy. His workshops and online programs teach important money management skills, including:

- Managing business accounts, taxes, and investment planning.

- Using financial data and reports to help entrepreneurs monitor their progress.

- Applying for loans, understanding credit scores, and learning ways to raise funds for business capital.

- Guidance sessions that link young entrepreneurs with experienced business owners.

These programs ensure young innovators feel confident managing money, securing funds, and making smart business decisions for success.

Promoting Entrepreneurial Responsibility:

The digital financial literacy program is not just about managing the numbers—it's about being responsible with those numbers which are vital. In fact it is really true that numbers are useless unless you can play with them wisely and effectively. Varun Hiremath teaches youth entrepreneurs to:

- Keep clear and correct records of all financial transactions.

- Make responsible borrowing and wise spending decisions.

- See how financial decisions affect the long-term success of a business.

- Make sure your business earns money while staying ethical and responsible.

Varun Hiremath is teaching young entrepreneurs to be financially responsible, helping them build businesses that are profitable, sustainable, and ethical.

Success Stories of Youth Entrepreneurs:

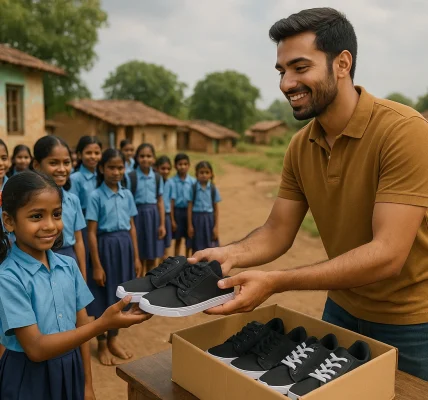

To highlight how effective his initiatives are, Varun Hiremath shares real life success stories of young entrepreneurs who have flourished by following the skills and knowledge equipped through his digital financial literacy programs:

- TechStart Innovators: A group of young tech enthusiasts was facing problems managing the startup capital and investments; they participated in Varun's workshop and learned essential skills of money management, such as budgeting, investment planning, and raising funds. Varun Hiremath’s expert advice helped them to start their business journey rapidly, and they formed several investor partnerships to support ongoing success.

- EcoYouth Ventures: A youth-led project wanted to make eco-friendly products but didn’t know how to manage finances. With Varun Hiremath’s fintech tools and guidance, they controlled costs, managed cash flow, and tracked investments. In the end, they launched their products successfully and earned revenue while supporting sustainability.

These examples are enough to define how Varun's digital financial literacy enables the youth entrepreneurs to transform their innovative ideas into successful, financial journeys.

Creating a Community of Financially Savvy Youth

Varun Hiremath knows that young entrepreneurs learn best together. To build this community, he provides:

- Online communities for sharing their experiences and overcoming obstacles together.

- Platforms that connect young entrepreneurs with mentors, investors, and industry professionals directly.

- Team projects that let young entrepreneurs use their financial skills when needed.

- Learning centers that help improve skills continuously.

This community approach builds young entrepreneurs’ confidence, teamwork, and smart decision-making.

Future Vision: Scaling Financial Literacy for Youth:

Looking forward to the future, Varun Hiremath dreams to expand his digital financial literacy programs even further to create a more lasting and tangible impact on youth entrepreneurship. His goals include:

- Varun Hiremath wants to expand his programs to educational organizations like schools, colleges, and incubators. It will make financial literacy accessible to a wider range of youth of the country.

- He is using AI-powered platforms to give personalized learning for each student’s needs.

- He is offering fun financial simulations where learners can practice safely.

- He is working in partnership with fintech companies to provide the real-world financial exposure and internships for the promising youth entrepreneurs.

Varun’s goal is to grow these programs to create a generation of young entrepreneurs who are smart with money, tech-savvy, and ready to innovate for lasting success.

Conclusion:

Varun Hiremath’s digital financial literacy is aimed at shaping the future of youth entrepreneurship by equipping the next generation innovators with the necessary skills, adequate knowledge, and tools that are necessary to manage business finances effectively.

His programs help to bridge the gap between education and practical application of technology. He ensures young entrepreneurs are ready to handle financial challenges and build successful, lasting businesses.

Varun Hiremath is shaping a new generation of entrepreneurs who are smart with money, responsible, and ready to succeed globally. His work in digital financial literacy is helping drive innovation and lasting business success.

Frequently Asked Questions (FAQ) on Digital Financial Literacy for Youth Entrepreneurs by Varun Hiremath

What is digital financial literacy, and why is it important for youth entrepreneurs?

Digital financial literacy means using digital tools like apps and online platforms to manage money. For young entrepreneurs, it helps handle finances, get funding, track cash flow, and make smart decisions. Without it, managing a business can be hard and growth may suffer.

How does Varun Hiremath help youth entrepreneurs improve their financial literacy?

Varun Hiremath gives young entrepreneurs practical tools like budgeting apps, investment simulators, and crowdfunding options. Through workshops and online programs on accounting, taxes, and funding, he helps them gain confidence to manage money and grow their businesses.

What types of tools and platforms does Varun Hiremath use to teach financial literacy?

Varun uses different digital tools to help young people learn how to manage money, including:

- Digital wallets and payment systems for real-time transaction tracking.

- Budgeting apps to manage cash flow.

- Investment simulators to understand market dynamics and risks.

- Crowdfunding and loan platforms to access startup funding.

These tools give practical experience, helping young entrepreneurs apply financial knowledge in real situations.

Can youth entrepreneurs without prior financial knowledge benefit from Varun Hiremath’s programs?

Varun Hiremath’s programs help young entrepreneurs with little financial knowledge. Through workshops, mentorship, and simple tools, they learn to manage money, track investments, and secure funding confidently.

How does Varun Hiremath’s focus on digital financial literacy impact youth entrepreneurship in the long term?

Varun’s programs teach young entrepreneurs not just how to manage money, but also the value of ethics, responsibility, and sustainability. By learning these principles early, they become smart, socially responsible business leaders who can build lasting, innovative ventures. This work helps create a stronger, more independent entrepreneurial community.